This was my play from last weeks newsletter - NUGT since it's down the most of all the swings I own here is my strategy with that stock. My first entry was

Feb 11th = 651 shares $7.68

Feb 19th = 826 shares at $6.05

Currently at $5.80 - yesterday went over $6.00 and executed the covered calls just great - nice save there!!!!

I am going to Sell Covered Call Options as I hold the stock for next 40 days.

These Options Expire at the close on market on Friday April 19th

I will sell 14 contracts which cover my 1,400 shares

The Option is the $6.00 Strike Price on the April Month. The Option Contract Price Closed $.65 - as the stock rebounds to $6.00 I will place the trade - SELL 14 CONTRACTS APRIL $6.00 STRIKE PRICE COVERED CALL WRITE - Looking for a price of $.75 to $1.00 - this will give me a $6.75 to $7.00 sale price on 3rd Friday of April.

MOJO Day Trading is quickly becoming a name on Wall Street for stellar stock picking and trading education. ProTrader Mike will show you exactly how to become a profitable stock trader even if you're an beginning trader. The blog contains valuable information for both day and swing trading styles. Main Website = www.mojodaytrading.com

Tuesday, February 26, 2013

ANFI Update 2/26

ANFI came out with great earnings yesterday and set a high of $7.50. It backed off today and closed at $7.08. As soon as earnigns where positive I went and added to the Model Swing Potfolio at $7.15 another entry positon. At 7:42 p.m. this evening news came out and in After Hours the traded at $8.17.

Headlines

- New Star Analyst Rankings for Amira Nature Foods Ltd OrdinaryStarMine(Tue 7:42PM EST)

- Amira Nature Foods' CEO Discusses F3Q2013 Results - Earnings Call Transcriptat Seeking Alpha(Mon, Feb 25)

- Amira Nature Foods Ltd. Earnings: Everything You Must Know Nowat Wall St. Cheat Sheet(Mon, Feb 25)

- InPlay: Amira Nature Foods beats by $0.04, beats on revs; guides FY13 revs in-lineBriefing.com(Mon, Feb 25)

- Q3 2013 Amira Nature Foods Ltd Earnings Release - Before Market OpenCCBN(Mon, Feb 25)

- Amira Nature Foods Ltd Announces Third Quarter Fiscal Year 2013 Financial ResultsBusiness Wire(Mon, Feb 25)

TELK Update 2/26

EVC Update 2/26

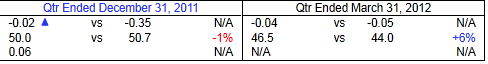

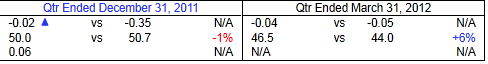

Earning are due after the close of the market on 2/27 - Expecting a quarter like this and we will buy more and hold for another 3 months until next quarter.

Going up against a loss of $.02 - hey did $.08 last quarter and looking for a positive number and Sales of $62 million plus.

Going up against a loss of $.02 - hey did $.08 last quarter and looking for a positive number and Sales of $62 million plus.

MRGE Update 2/26

Last week stock went to $2.90 and we did not sell. It fell off hard and looking half next time stock surges back above original buy price of $2.73 - long aslso on Scale Entry #2 at $2.56 - longest holding so far

Saturday, February 16, 2013

The key to trading is BANKROLL MANAGEMENT!

The key to trading is BANKROLL MANAGEMENT! As a trader your number one job is to manage risk. Your max loss on any trade should never be more than 10%. The more you lose, the more you must make to back to get back to break-even point. The grid below shows you why we never want to lose more than 10% on a single trade.

The following chart exhibits the challenge of making your investment back after you lose it. Notice that the more you lose, the amount needed to breakeven grows exponentially. This is because the money lost is capital that is no longer available for investment. If you lose only 10%, you still have 90% of your capital available for investment. If you lose 50% you only have 50% of your capital available for investment, so a 100% gain is required to get back to breakeven.

Why It's So Important to Avoid Investment Losses?

When you experience large losses day trading or swing trading you have less to invest and then your portfolio is in a position that will probably take years to get back to breakeven. The reality of break-even loss analysis makes losing 50% of your money intolerable! Even if the market gained 10% per year, and you were 100% invested, it would take 7 years (7 instead of 10 because of compounding) to get back to breakeven. This is unacceptable. You need to invest in a way that allows you to buy low and sell high, not the opposite.

Investment Losses and Risk Management

All Day Traders & Swing Investors need to have a capital preservation plan that includes controlling investment losses. Many in the financial industry will tell you to place stops on your individual stocks. But is it possible they recommend this because it creates more trading and therefore more commissions? Why should you sell a stock when it goes down? If the company’s prospects haven’t changed maybe you should buy more not sell at a loss. What if you used a tactical asset allocation to minimize investment loss and buy more stocks when they are bargains?

Instead of putting stop losses on individual investments, develop an asset allocation for your portfolio that controls your investment losses. Most investors invest too aggressively; they have been taught an outdated buy and hold strategy that forces them to sell in bear markets because they get to the point where they can’t stand the pain of a bear market anymore, and they sell at the wrong time.

More on Scaling Techniques will be covered in the next lesson ...stay tuned and thanks for reading...Good Luck Trading

The following chart exhibits the challenge of making your investment back after you lose it. Notice that the more you lose, the amount needed to breakeven grows exponentially. This is because the money lost is capital that is no longer available for investment. If you lose only 10%, you still have 90% of your capital available for investment. If you lose 50% you only have 50% of your capital available for investment, so a 100% gain is required to get back to breakeven.

Why It's So Important to Avoid Investment Losses?

When you experience large losses day trading or swing trading you have less to invest and then your portfolio is in a position that will probably take years to get back to breakeven. The reality of break-even loss analysis makes losing 50% of your money intolerable! Even if the market gained 10% per year, and you were 100% invested, it would take 7 years (7 instead of 10 because of compounding) to get back to breakeven. This is unacceptable. You need to invest in a way that allows you to buy low and sell high, not the opposite.

Investment Losses and Risk Management

All Day Traders & Swing Investors need to have a capital preservation plan that includes controlling investment losses. Many in the financial industry will tell you to place stops on your individual stocks. But is it possible they recommend this because it creates more trading and therefore more commissions? Why should you sell a stock when it goes down? If the company’s prospects haven’t changed maybe you should buy more not sell at a loss. What if you used a tactical asset allocation to minimize investment loss and buy more stocks when they are bargains?

Instead of putting stop losses on individual investments, develop an asset allocation for your portfolio that controls your investment losses. Most investors invest too aggressively; they have been taught an outdated buy and hold strategy that forces them to sell in bear markets because they get to the point where they can’t stand the pain of a bear market anymore, and they sell at the wrong time.

More on Scaling Techniques will be covered in the next lesson ...stay tuned and thanks for reading...Good Luck Trading

Wednesday, February 13, 2013

Archery what does that have to do with DayTrading?

How is Archery like DayTrading - what are you joking?

I will use today's PPHM as an example - Here's how I look at it - When you buy a stock - you better look at the volume. In this case the average volume is 3 million shares. On a day like that if you bought the stock - the sell target for a higher sale price and profit may come around to you one one or two times. Meaning, your an Archer with the Arrow every time you buy - then the target starts to move and circles 360 degrees around you until it comes front view to shoot at once again The sharper you are and more accurate the better you hit the tops selling as the stock is surging up and profits present themselves. Now if you do not take the profit and the stock sells off you have to wait, and wait and wait until that target circles back around for another shot, if it ever does.

So what makes this target circle around you many times and gives you many shots at profits = IS THE VOLUME. The bigger it is for that stock the more times you have to make money with it.

KEEP in mind the time of the day when you do this as if it's 10:00am you get many chances during the day but if the stock market is closing in half hour you may not get any. So be aware of how much time you have left to score and hot a BULLSEYE!!

Paralysis of Analysis

I have been asked several times lately by new traders how to overcome the fear of placing trades. Just today with CREE and UVXY and even PPHM to BUY people cant PULL THE TRIGGER - which transcends into the same TENDENCY TO BE PARALYZED AND NOT TAKE LOSSES AND OBEY YOUR STOPS WHEN IT IS TIME TO SELL. PRETTY CRAZY WHEN YOU THINK ABOUT IT. WELL DO SOMETHING TO CHANGE IT!!

One bad trade takes away 5 good ones and takes you back 2 days to make that back. So stay on course follow rules and it will make trading much easier and less stressful.

Today we saw the setup, but couldn't quite pull the trigger. The setup worked just as they planned, yet they missed the trade. I never have this problem. In fact, as I have said before, I had quite the opposite problem. However, having talked to many traders, I do know a little bit about this topic. Lets discuss a little thing known as paralysis of analysis.

The term ”paralysis of analysis” refers to over-analyzing (or over-thinking) a situation, so that a decision or action is never taken, thus paralyzing the outcome. Paralysis of analysis occurs in all parts of life, not just trading. Perhaps you have a great idea for a new social media site, but you don’t know how to go about getting started. You don’t know how to get the patent, or how to recruit investors for your idea, or whatever. So you are stuck, basically paralyzed and at a standstill. You will never be successful and never fulfill your dreams if you don’t figure out how to overcome this fear. Being paralyzed is great for new traders because you want to take the time to learn before placing trades. You cannot blindly follow a trader and expect to make money. You have to know the concept behind the trades and understand why the trade is being placed if you want to be truly successful. However, once you have taken this time to learn then how to do you muster up the courage to actually push the “buy” button and put your plan into action?? Well…..

The first thing that you must remember as you start to overcome this fear is that there is no perfect way to approach trading. Each individual must find an approach that is perfect for themselves. There is no perfect strategy that will “always” work in the stock market. Always doesn't exist. Learning to treat trading as an art form rather than an exact science is how you learn to be successful You enter stocks that have the highest probability setups, and you exit stocks when those setups don’t work, with your capital still intact. This is the key to success in trading.

The way that we teach you to overcome this analysis of paralysis at bulls is by following the 4 steps below:

1. Master high probability setups and know how they should act

If you are trying to read every book out there and use every indicator that has ever been placed on a chart, then you are without a doubt over analyzing this business and just going to run into a wall of confusion. Start by learning 1 or 2 setups and figure out what they are supposed to look like and how they are supposed to act. Start out just trading this setup.. then slowly add in another and another until you have a complete arsenal.

2. Start by taking small positions in the trades.

Trade the stock as if it were a normal position size. This will help you get your feet wet and get more comfortable with placing actual trades.

3. Have a game plan for the stocks you enter.

Know what type of trade it is that you are entering and what you expect out of the stock. If the trade doesn't go as planned, then sell the stock and move on. There are always other trades just around the corner. Cutting losses quickly on setups that go against you can be your greatest friend.

4. Keep a trade journal

Review your trade journal at night. Discuss everything in the journal why you want to enter the trade, your target prices, what that market is doing, what the sector of the stock is doing, your risk reward in the trade etc.. This will really help you to understand your trades and become a better trader.

Saturday, February 9, 2013

Mojo Limited Time Offer

Last Week, I

offered a One Week Free Trial to the first 50 signups of The Mojo Swing Alerts

Newsletter. 42 have already joined in just a few days!

Now, only 8 6 spots remain, by tomorrow this will end and

be sold out so hurry and join now.

Mirror Protrader Mike's 3-5 swing trade

picks every week and receive the Alerts instantly by Text and Email

right to your Inbox!

The newsletter

will be emailed to you before 9:00 a.m. on Monday, Wednesday & Friday of

every Week.

·

Monday will have new picks for the week from research done Sunday night.

(Sometimes includes a Video Production of the Newsletter)

·

Wednesday will have updates on the new picks as well as the core holdings.

·

Friday will have updates on the new picks as well as the core holdings.

The

Newsletter will contain high probability trade setups with detailed charting

analysis as to WHO the company is, WHAT prices to buy and targets to sell

(includes stops), WHY we are buying it, HOW far it can rise with specific

targets, WHEN the right time to buy will be. There will also be fun factoids,

questions of the day, and many other valuable Swing Trades Ideas and Tactics

you can use to advance your own trading.

Seriously, we're

crushing some serious stocks in past 2 months. My swing alerts putting $5,000

in each pick you would be up $42,048 so

far in February, what are you waiting for, Sign Up Now.

Some of the Mojo Traders have made a

killing on my picks in last 30 days. With KERX, AEZS, MJNA, HEMP traders have

made over $50,000 in just 30 days!!

I do the work and YOU make the profits. Give me 30 days and I will make you a

better trader!

Picks like

KERX, MJNA, HEMP are what you can expect from The Mojo Swing Alerts Newsletter

which I'm giving away FREE to the next 6 premium clients, it's $49 monthly

thereafter and it's selling out fast.

Friday, February 8, 2013

Market Update Week Feb 8th

|

Subscribe to:

Comments (Atom)